The tides of global investment and considerations are positively turning to Nigeria’s mini grid electricity market, writes OGN.

When the conference doors finally closed at the Sheraton Hotel Abuja and display banners rolled up and packed back for wherever they came from, it was almost obvious that a good shift in conversations around Nigeria’s mini grid electricity market had occurred.

For the more than 600 people with diverse expertise and interests in mini grid electricity operations who were part of the conference tagged: ‘Upscaling Mini Grids for Low Cost and Timely Access to Electricity Services’ and on which platform Nigeria’s mini grid electricity market was intensively deliberated, the paths to take were conceivably made clear.

Jointly organized by the Rural Electrification Agency (REA), the World Bank’s Energy Sector Management Assistance Program (ESMAP), the Climate Investment Funds (CIF), and the UK Department for International Development (DFID), Nigeria’s mini grid power market and its potentials to lift more than 50 per cent of her population without electricity services was the centerpiece of conversation at the December conference.

Over the five-day meeting, opinions shared with OGN by participants indicated that while the sector enjoyed a different level of devotion than it had ever seen, the outcome to a large extent was that ‘there is a sheer shortage of business intelligence’ to guide investments to the hugely lucrative mini grid electricity market in Nigeria.

From conversations on off-grid opportunities and challenges in same in Nigeria, to creating enabling environment for mini grid investments, access to finance and more importantly, engaging with State governments to push through investments, the discussions at the conference were germane and indicated the REA might have opted to ditch the sedentary life it had led and which defined the way Nigeria’s mini grid power market operated for years.

Opportunities missed

Despite the huge economic and social potentials in Nigeria’s mini grid power sector, too many factors have however contributed to ensure it never became an economic destination but more of a rental depot for politicians.

For many years since it was set up by Section 88 of a 2005 Electric Power Sector Reform Act (EPSRA), and its management board inaugurated on March 16, 2006, the REA which is charged with helping Nigeria’s federal government reach its commitment to providing electricity to all its citizens in the rural communities, had remained docile to its job.

Choosing to be lazy and uncreative, the REA in the past primarily engaged in awards of electricity distribution expansion contracts that were reportedly phony and meaningless to communities that ever got one. As an old practice, politicians and their friends flirted ceaselessly with the agency over contract awards and most frequently, electricity wires, transformers and poles would run through communities courtesy of the REA but no actual electrons put on them to electrify beneficiary communities.

In fact, the REA frequently been in the middle of political fights by political hawks jostling for its rural electrification contracts, didn’t only lose its focus, but also opportunities to truly open up the opportunities in Nigeria’s mini grid power market to the world of investors to put in their monies and create real values for rural folks who make up a good chunk of Nigeria’s population.

Due to the failings of the REA, key milestones such as the mini grid regulation, Rural Electrification Strategy and Implementation Plan (RESIP), Nigeria Renewable Energy and Energy Efficiency (NREEE) policy amongst others were inferred by operators to have been delayed and the market unable to take off.

But then…

The REA from the December conference exposed to the world the economic opportunities that it had lackadaisically buried away for so many years.

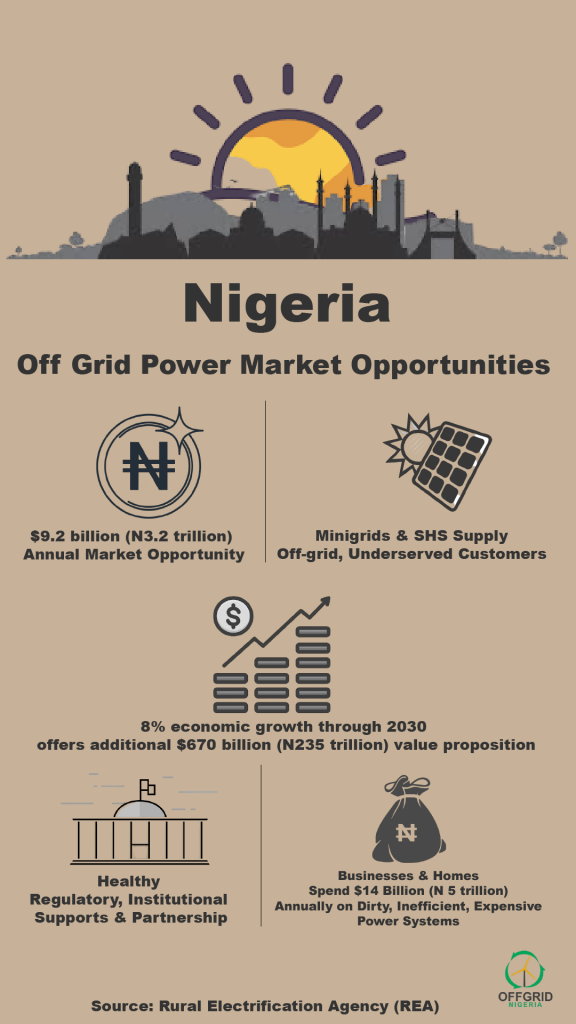

Opening up on its business findings, the REA said the annual investment potentials in Nigeria’s mini grid electricity market was now worth up to $9.2 billion, indicating that its recent studies on the market potentials confirmed there were enormous opportunities than the challenges the market talked about.

Its Managing Director, Damilola Ogunbiyi, said in a presentation: “Overview of the Off-Grid Opportunities and Challenges in Nigeria“, she made at the conference, that the country’s federal authorities had created an enabling environment for mini grid operators with the provision of a regulation to support the market’s growth.

Ogunbiyi, also said REA had made provisions for rural electrification fund, which she asked investors and developers to tap from to develop mini grid projects.

She explained that a $350 million support from World Bank would be dedicated to the development of mini grid electricity in Nigeria, and it would fund electricity projects to electrify 200,000 household and 50,000 entrepreneurs.

She emphasized in her presentation that Nigeria with her huge gap in municipal electricity supplies presented investors the biggest and most attractive off-grid opportunity in Africa.

The country, Ogunbiyi, added, was also one of the best locations in the world for mini grids and solar home systems.

According to her, with a GDP of $405 billion, 180 million people (about half of which are un-electrified), and a flourishing economy (with a compound annual growth rate of 15% since 2000), Nigeria ticked all the right boxes for investment in mini grid power solutions.

Similarly, she noted that a significant amount of the country’s economy was powered largely by small-scale generators (10–15GW), resulting to an almost $14 billion (N5 trillion) annual spend on inefficient and expensive ($0.40/kWh or ₦140/kWh on the average compared to grid power) power generation systems that are also noisy and polluting.

So, why come to Nigeria?

In a direct response to this, Ogunbiyi, stated in her presentation that: “Developing off-grid alternatives to complement the grid creates a $9.2B/year (N3.2T/year) market opportunity for mini grids and solar home systems that will save $4.4B/year (N1.5T/year) for Nigerian homes and businesses.”

She added to buttress the opportunities and why Nigeria could remain attractive to investors for a long time: “There is a large potential for scaling – installing 10,000 mini grids of 100kW each can occur by 2023 and only meet 30% of anticipated demand.”

The domino effect a healthy Nigerian mini grid electricity market could have on the rest of Africa, Ogunbiyi, pointed out were that: “Getting off-grid solutions to scale and commercial viability in Nigeria will unlock an enormous market opportunity in Sub-Saharan Africa across 350 million people in countries with smaller demand and/or less-robust economies.”

The REA, she assured investors has in anticipation created the Off-Grid Electrification Strategy which is part of the Power Sector Recovery Programme (PSRP) to ensure this pushes the market to commercial viability.

And, Branson, confirms attraction, feting…

Days after the conference, English billionaire and owner of Virgin Group, Sir Richard Branson, took to his personal blog to offer an exceptional business review on Nigeria’s mini grid sector.

Coming from a renowned business person, and one who has had previous business experience in Nigeria, the review to a large extent offered cynical investors an opportunity to take deeper look in on the country’s mini grid electricity market.

It in fact inferred that there were huge opportunities that global investors could take advantage of in Nigeria’s renewed efforts to connect over 80 million of her citizens currently without any form of electricity, adding that recent reports that Nigeria’s mini grid electricity sector was worth up to $9.2 billion per annum, was encouraging from an investment point of view.

While Branson did not state if he would put his money in the sector, he however suggested to investors in mini grid power systems that 2018 would be a bumper year for Nigeria’s mini grid market, and that they should head there if they were interested in taking from the $9.2 billion potential profit the market offered.

“Energy access in Africa is close to my heart. Bringing clean, renewable power to people instead of building coal-fired power stations is absolutely essential if we are going to tackle climate change,” he said.

He further explained: “Developing off-grid alternatives to complement the grid could create a $9.2B/year market opportunity for mini-grids and solar home systems that will save $4.4 B/year for Nigerian homes and businesses. And there is large potential for scaling – installing 10,000 mini-grids of 100kW each can occur for 10 years and only meet 30 per cent of anticipated demand.”

According to him: “The combination of large revenue opportunity (USD $9.2 billion per year), a supportive government, and a dynamic entrepreneurial environment unite to make Nigeria the ideal location. If you are an impact investor that wants to make a difference in energy access next year, I’d suggest a trip to Nigeria.”

Branson, noted that even though investors have viewed the market for mini-grids as being too risky, making gaining access to project financing rare, and market rate debt expensive, he was however, “really thrilled to hear this week that the Rocky Mountain Institute may have cracked the problem with their partners, the Nigerian Rural Electrification Agency and the World Bank.”

The organisations, he explained, released an independent investment brief that touts Nigeria as the nation which can now unlock the nascent mini-grid market in Africa in 2018.

“Nigeria is the biggest and most attractive off-grid opportunity in Africa. It has the largest economy in Sub-Saharan Africa (GDP of $405 billion), a population of 180 million people, and flourishing growth (15 per cent a year since 2000).

“A significant amount of the economy is already powered largely by small-scale generators (10–15 GW) and almost 50 per cent of the population have limited or no access to the grid. As a result, Nigerians and their businesses spend almost $14 billion annually on inefficient, polluting and noisy generation that is expensive, and suffers from poor quality,” he added.

But, there are also fears beyond the excitements…

As it is natural with every human events, fears of uncertainties for local players were equally expressed at the conference despite the overwhelming excitements about what could come.

Local operators who had for years weathered the storm and hard times without any form of government supports randomly shared their views with OGN. They primarily expressed fears that investors with huge financial cache would eventually crowd them out of the market or perhaps push them down the rung as stepping stones.

They noted that with a lot of influence, foreign companies could push and get favourable business terms they never ever get from the government, adding that the market could become preferential in the long run.