Nigeria’s peculiar challenges with inadequate electricity supplies to a good number of its citizens have led investors and operators to develop and adopt resourcefully tailored business models and renewable technologies to drive up access to electricity in the country, chief executive officer of All On, Dr. Wiebe Boer, has disclosed.

Boer, a 2015 Tutu Fellow said in a literature he wrote in the African Business Magazine, that the development of the new model and technologies indicated that with the right financing, regulation, and consumer aspiration, the country’s off grid power sector was at a tipping point.

He explained Nigeria still had lots of structural barriers to providing access to electricity for about 120 million people he said lacked electricity at the moment, and would need to address these barriers.

“New and improving renewable and gas to power technologies and business models adapted to the particularities of the Nigerian market are emerging, suggesting that with the right financing, regulation, and consumer aspiration, the sector is at a tipping point in the country,” said Boer.

According to him: “The problem (power shortage) is particularly acute in Nigeria, which has an estimated energy gap in the range of 30GW to 175GW, a gap that will cost between $40bn and $200bn to address. Research shows that an estimated 28m households and 11m SMEs in Nigeria are either off grid or receive less than four hours of power per day (bad grid).”

“This amounts to 120m people living without access to reliable and affordable power – or 75% of the population. Nigeria is already the world’s most off-grid country, with up to 60m generators in the country generating far more energy than the national grid. But this approach, using expensive dirty fuels, is not efficient, cost-effective, environmentally sound, nor sustainable,” he added.

Boer explained the access-to-energy challenge in Nigeria required a combination of both the traditional large-scale power generation approaches and distributed power innovations that are smaller scale, lower cost, and quicker to market, to be addressed.

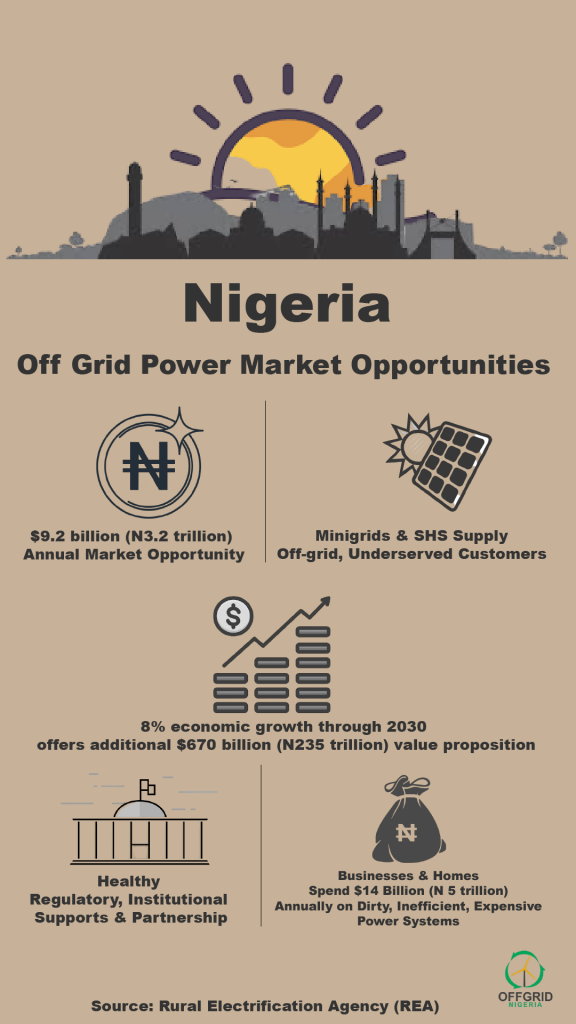

He noted that while the government had put in place an attractive regulatory environment and was supporting the growth of the off-grid energy sector through the Rural Electrification Agency (REA), there still remained major barriers for deployment of access to energy in the country.

Boer listed the inconsistency to include import duties, the lack of mobile money penetration, and financing.

He also stated that market studies conducted by Dalberg in 2016 suggest that in Nigeria’s south region alone, there is a high willingness to pay for off-grid power with an estimated annual spend of $825 million.

“Extrapolated across the country, this amounts to $10bn in annual spend for off-grid energy. Other data suggests that Nigerians are willing to pay substantially more for alternative energy sources than their counterparts in East Africa and India, and also that the typical Nigerian household has a higher power load requirement.

“Recognising the opportunity for substantial economic and social impact, there is an ever-increasing set of home-grown and international businesses entering the space, along with a growing number of investors.

“In the midst of all this activity, new business models are emerging where there is a convergence of solar home systems and mini grids, as well as business models where the generation and distribution for mini grids is separated,” he stated.